Online Tools & Helpful Resources

Learn more about your benefits and get more from your Blue Option plan.

All of our Blue Option health plans include routine pediatric and adult vision coverage through an independent company, EyeMed.

You have access to a mix of in-network providers – including independent eye doctors and popular retailers such as LensCrafters®, Target Optical® and Pearle Vision®.

You can even use your benefits online at Glasses.com, ContactsDirect.com, LensCrafters.com, TargetOptical.com, Ray-Ban.com and Oakley.com.

Our plans include a reimbursement for preventive care, which includes exams and cleanings from a licensed South Carolina dentist.

Adults (ages 20 and over) and children (ages 19 and under) get:

- One exam every six months, a $50 allowance for an initial appointment or a $50 allowance for periodic appointments.

- One cleaning every six months with a $50 allowance.

You will be responsible for paying any additional balance above what we cover. You will need to submit a dental reimbursement form with a bill or receipt from the dentist to BlueChoice HealthPlan for reimbursement.

For example, if your dentist charges you $130 for an initial cleaning and exam, you will pay your dentist $130 at the time of service. We will reimburse you $100 once we receive your reimbursement form.

Please note: You can visit any South Carolina licensed dentist. Costs incurred from these services do not count toward maximum out-of-pocket (MOOP) expenses.

All plans that have a copayment provide you with the convenience of an all-inclusive office visit copayment.

What does that mean?

If you visit a participating in-network provider, you will pay one copayment for all covered services performed in the doctor’s office for the same date when billed by the physician. Best of all, there are no dollar maximums!

Here are a few examples of what is covered under the all-inclusive office visit copayment:

- Office charges, including surgical services or treatment of an illness, accident or injury

- Allergy and tetanus shots

- Annual physicals

- Injections (immunizations)

- Diagnostic lab and X-ray services (Other charges could apply if the provider sends the claim to a hospital for processing.)

The all-inclusive office visit copayment benefit encourages members to see a contracting provider of their choice to establish and maintain a relationship, improving their health care experience.

Ensure laboratories are in network by using the Find Care tool.

The copayment does not apply to high-deductible (HD) plans.

We want to make sure you have the most current information about your health plan. Get important information delivered right to your phone when you sign up for our text messages.

Messages include:

- Important plan updates

- Health and wellness reminders

- Ways you can save

... and more!

Get started

You can sign up when you register for My Health Toolkit®. If you already have an account, you can update your contact preferences by going to your profile settings.

The FOCUSfwd Wellness Incentive Program is designed to help you lead a healthier lifestyle.

Complete our FOCUS Points and GET FIT programs and earn up to $110 in rewards. Plus, increase your chances of winning one of the $1,000 quarterly and $5,000 annual cash rewards in our Sweepstakes!

Everyone needs some advice from time to time.

That’s why My Life Consult offers you and those in your household three free life management sessions and three counseling sessions to help you tackle some of life’s most challenging decisions.

Services Include:

- Financial counseling and planning.

- Adult care services.

- College consultation resources.

- Legal consultations and documents.

- Child care resources.

- Parenting or adoption services.

Dedicated professionals are available to serve you 24 hours a day, seven days a week. Call

My Life Consult services are offered through First Sun Employee Assistance Program (EAP). Because First Sun EAP is a separate company from BlueChoice HealthPlan, First Sun EAP is solely responsible for all services related to individual assistance programs.

Access your Blue Option Member Policy. Our Member Policy gives you answers regarding:

- When your coverage begins and ends.

- Covered services.

- Services and supplies we don't cover.

- General contract provisions.

... and more!

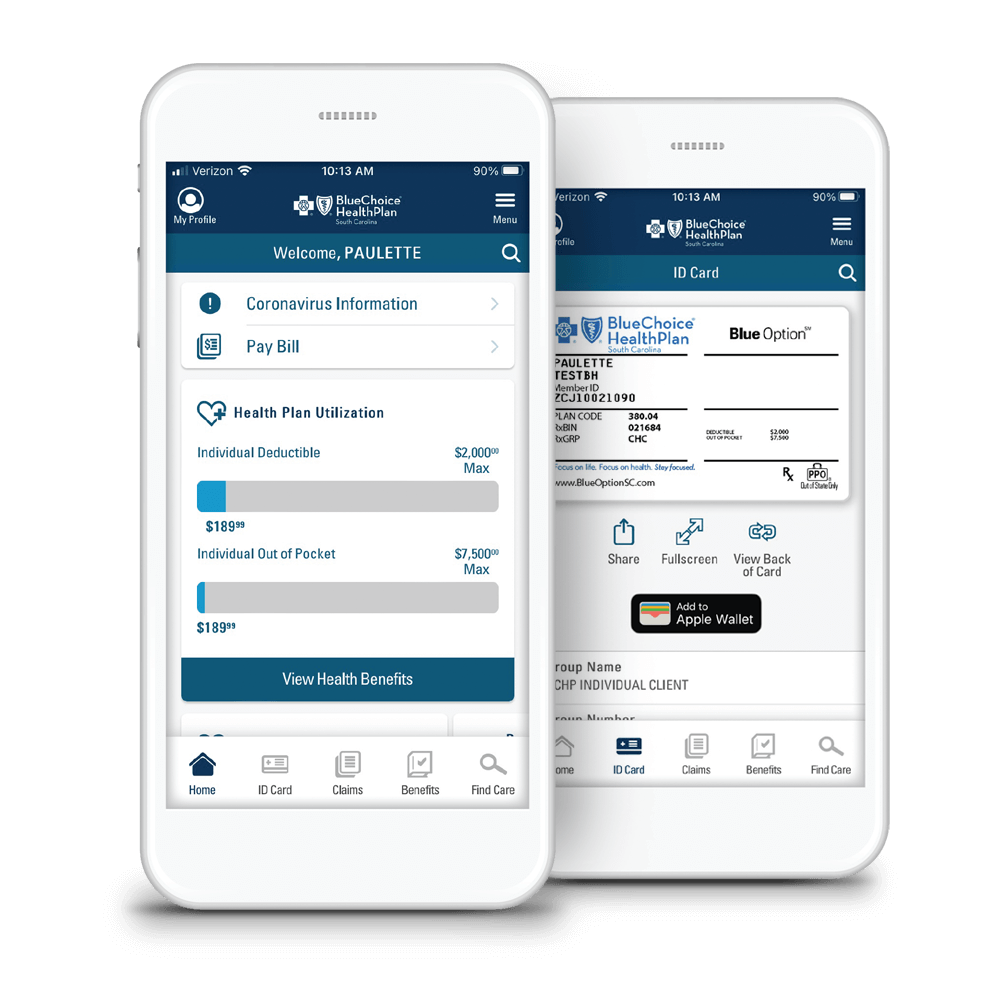

Your favorite features from the website are now available in a mobile app. With the My Health Toolkit app, you can:

- View and share your digital ID card.

- Check the status of your claims.

- Confirm your coverage for services.

- Find a doctor or hospital in your network.

- Manage your medical spending accounts.

... and more!

Just grab your mobile device and search for “My Health Toolkit” in the App Store or Google Play.

Once downloaded, you can log in with your existing username and password. If you need help with the app, we've got you covered there, as well.

My Health Novel matches you with helpful resources and tools based on your specific health needs. With it, you can access weight management, behavioral health and musculoskeletal health mobile apps at no cost.

When an email contains sensitive information, we will send it via a secure method. That means you will need to create a password to open it.

It's a straightforward process, but we have provided detailed instructions on how to access these secure emails in the event you need some assistance.

The Outline of Coverage gives you answers on:

- Benefits.

- BlueCard.

- Inpatient and outpatient services.

... and more!

We offer an easy-to-understand summary of a health plan’s benefits and coverage, referred to as a Summary of Benefits and Coverage (SBC). An SBC includes plan details, called “coverage examples,” that let you see what the plan covers for certain health conditions or medical situations.

A new movement in the medical community reminds patients to ask follow-up questions to gain a fuller understanding of their options and get better care.

The Always Stay Knowledgeable (ASK) program was created in 2018 to raise awareness about low-value care. Its goal is to make sure health care facilities are providing high-value care that makes a real difference. It aims to reduce unnecessary care and improve health outcomes through better conversations between patients and providers.

How To Pay Your Bill

Need to pay your bill? We offer several convenient ways to do just that.

Online

To pay using a Visa, Discover or MasterCard credit card, please visit us online at www.quickbillsc.com.

By Phone

If you would like to pay by phone, please call us at:

You will need routing and account numbers from your checking account.

Through the Mail

You can also mail your payment to this address:

Attn: LockBox

BlueChoice HealthPlan

P.O. Box 100216

Columbia, SC 29202-3216

In Person

Visit one of our South Carolina BLUESM Retail Centers to pay in person.

Columbia:

7467 Saint Andrews Road

Irmo, SC 29063

Monday – Friday, 9 a.m. – 5:30 p.m.

803-264-9000 (Phone)

Greenville:

Magnolia Park Mall

1025 Woodruff Road, Suite A105

Greenville, SC 29607

Monday – Friday, 9 a.m. – 5:30 p.m.

Saturdays by appointment only

864-286-2285 (Phone)

Mount Pleasant:

1795 Highway 17 North, Unit 7

Mount Pleasant, SC 29464

Monday – Friday, 9 a.m. – 5:30 p.m.

Saturdays by appointment only

843-216-7760 or 855-492-2583 (Phone)

Myrtle Beach:

3701 Renee Drive

Myrtle Beach, SC 29579

Monday – Friday, 9 a.m. – 7 p.m.

843-736-8811 (Phone)

Please note that you have an age-rated policy. This affects anyone on your policy age 15 or older. It means there will be an age-related rate change every year for those members. If you or a member on your policy is age 15 or older in 2025, you will see your rate change starting Jan. 1, 2026, and every January thereafter.

Keys To Using Your Coverage

- The best way to get information about your benefits

We are always happy to answer your questions about benefits or anything else. You have a lot of information at your fingertips.

Send us an email through our secure My Health Toolkit. If you are using it for the first time, you will need to create a profile — it just takes a few minutes. Read your Schedule of Benefits. We send you this when you first become a member, and whenever your benefits change. You can also view your benefits in My Health Toolkit. View your Member Guide.

You can also call us at the number on the back of your ID card to request we mail you a copy of your Schedule of Benefits or Member Guide.

- What to do if you need care after hours

If you select a primary care physician (PCP), he or she has an agreement with us to provide 24-hour call coverage. This means no matter when you call your PCP, someone will answer the phone and advise you of the proper action to take based on your condition.

If an emergency arises, try to phone your PCP first. If he or she is unavailable, you can go directly to the nearest Doctors Care or other urgent care provider. However, if your condition is life- or limb-threatening, you should go directly to the nearest emergency room. As soon as possible, let your PCP know about any emergency care you have received.

- Phone ahead for appointments and cancel at least 24 hours in advance

This helps you receive your medical care on a more timely basis. When you call first, your doctor's staff will arrange for the most appropriate care — either an appointment or advice for an ailment.

If you must cancel any appointments, please let your doctor's office know as soon as possible. Some physicians may charge for missed appointments and BlueChoice® HealthPlan does not cover those charges.

- Make the most of your appointment

Be prepared to ask your doctor questions and provide as much background about your health as you possibly can. On your first visit, bring all the medicines you currently take. Your doctor will need this information to assess your medical condition and monitor possible drug interactions.

Here's a helpful checklist to make sure you're keeping up with you and your child's health.

- Always bring your ID card with you

Whenever you seek medical care, be sure to identify yourself as a BlueChoice® HealthPlan member. When you arrive for your appointment, present your member ID card to the office staff.

Now you can access your digital ID card anytime, anywhere from your computer or mobile device. Your digital ID card is identical to your physical card. It contains your member ID number and other coverage details that are unique to you. Unlike your physical card, you don’t have to worry about losing it or ordering duplicate copies for your family.

To access your card, simply log into your My Health Toolkit account.

- Help yourself stay healthy

Take advantage of our Great Expectations® for health programs. We can help you stop smoking, control your diabetes or decrease your risk for heart disease. You'll learn to breathe easier with our asthma management program.

Expectant moms count on our maternity program to provide information and support, which can help them deliver healthy babies. We even have a special program for women only. For more information, call our Health Management department at 855-838-5897.

- Choose a primary care physician

We strongly recommend you choose a primary care physician (PCP). This is a doctor who specializes in family medicine, internal medicine or pediatrics (for children and adolescents).

These doctors are trained to diagnose and treat many illnesses and manage chronic conditions, such as diabetes, high blood pressure and asthma. PCPs also provide preventive care, routine screenings and immunizations.

Should you ever need a specialist or other type of doctor, your PCP can recommend one in your Blue Option network and coordinate your care with him or her. Always seek care from your PCP first, unless it's an emergency.

- Practice prevention

Nothing beats planning ahead when it comes to your health. Regular exams are one of our most attractive benefits, so make sure you practice preventive care. Here are guidelines for adults, as well as children and adolescents, seeking preventive services.

- Where you go for care matters

We care about you and want to help you take charge of your health. Avoid needless worry, out-of-pocket costs and hours sitting in the emergency room (ER) by knowing how to navigate through the health care system and being familiar with other options for your care.

Primary Care Physician

Your primary care physician (PCP) should be your first choice for health care. Don't have a PCP? Find one here, or give us a call at 855-838-5897. We can help you find a doctor that fits your needs.

See your PCP for common medical issues:

- Illnesses such as colds, flu, earaches and sore throats

- Minor injuries such as sprains, strains and back pain

- Routine physical exams, vaccinations and screenings

- A health problem for which you need advice

The ER is not a substitute for a PCP visit. Going to the ER for something that is not a true emergency could result in long wait times and may result in your claim not being paid. The good news is that you have options! And if you're ever in doubt, err on the side of caution and seek immediate care.

When Should I Go to the ER?

- Sudden or unexplained loss of consciousness

- Signs of a stroke

- Poisoning

- Signs of heart attack

- Severe shortness of breath

- Medication or drug overdose, alcohol poisoning

Network Urgent Care Clinics

Urgent care centers provide another option when you need care and your regular doctor is not available. Urgent care centers provide attention for medical problems that need seeing to right away but are not life-threatening, or for problems that could get worse if you wait.

An urgent care visit usually takes less time than a hospital emergency room and costs you much less.

For more information about making the most of your benefits and navigating the complex health care system, contact our team:

Monday – Thursday, 8:30 a.m. – 8:00 p.m. EST

Friday 8:30 a.m. – 5:00 p.m. EST

Access Your Online Resources

Sign up for an in-network provider, check your claims status and authorizations, find a particular prescription drug, get information about our wellness programs, and so much more.

All About Deductibles

Learn about deductibles, including how they can affect monthly premiums, in our short video.

Learn About Coinsurance

Understand the lingo and find out the purpose of coinsurance in this short video.

What's an Explanation of Benefits?

Watch this animated video to learn what an Explanation of Benefits (EOB) is and what it means for your health insurance coverage.

With You Wherever You Go

Your favorite features from the website are now available in a mobile app. With the My Health Toolkit® app, you can:

-

View and share your digital ID card.

-

Check the status of your claims.

-

Confirm your coverage for services.

-

Find a doctor or hospital in your network.

And more!